Power of Sale Appraisals: Ensuring Fair Value

Designated Appraiser with Appraisal Institute of Canada & Licensed Real Estate Broker with RECO/TREB

What Is a Power of Sale Appraisal?

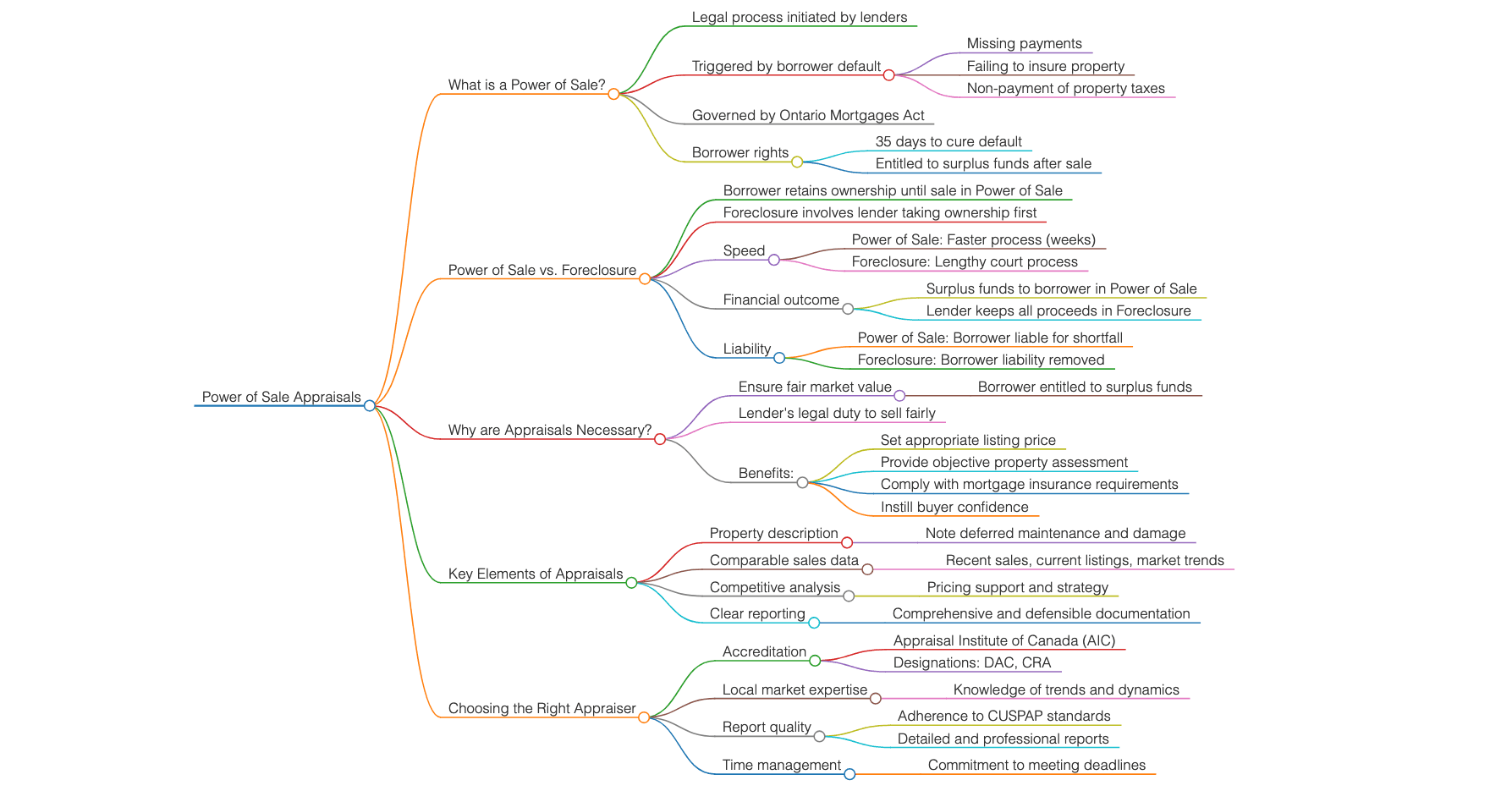

A power of sale appraisal is an independent evaluation of a property's current market value, conducted by a certified appraiser when a mortgage borrower defaults and the lender initiates power of sale proceedings to recover the debt. These appraisals are crucial for establishing a fair, defensible listing price that protects the interests of borrowers, lenders, and prospective buyers. Given the high stakes, power of sale appraisals demand rigorous analysis, meticulous reporting, and strict adherence to industry standards.

The Critical Role of Power of Sale Appraisals

In Ontario's dynamic real estate market, power of sale appraisals play a pivotal role in balancing the interests of lenders, borrowers, and buyers when a mortgage goes into default. These professional valuations provide an objective, evidence-based assessment of fair market value, helping to ensure the sale process is transparent, efficient, and equitable for all parties.

Why Are Power of Sale Appraisals So Important?

Ensuring Fairness for Borrowers

Power of sale appraisals provide an objective, market-based assessment of the property's value. This helps protect distressed borrowers by establishing a fair and reasonable selling price, rather than an artificially low one that could deprive them of their rightful equity. The appraisal report serves as evidence that the lender is committed to handling the borrower's assets responsibly.

Compliance for Lenders

In Ontario, lenders are legally required to take reasonable steps to obtain fair market value when selling a property through power of sale. An independent, professional appraisal demonstrates the lender's diligence in meeting this obligation. This protects the lender from potential liability issues down the line.

Key Elements of High-Quality Power of Sale Appraisals

Property Inspection

A power of sale appraisal begins with a thorough, full-access inspection of the property. During this inspection, our appraiser meticulously documents the property's current condition that could affect the property's market value and saleability. This detailed assessment provides a crucial point-in-time record of the property's state, forming the foundation for an accurate valuation.

Examination of Market Data

The appraiser conducts deep research into recent comparable sales, current listings, and overall market trends. This analysis establishes a firm foundation for the valuation, ensuring it reflects the realities of the local market. The appraiser's ability to interpret this data and provide meaningful context is a hallmark of a quality power of sale appraisal.

Valuation Analysis

With the property and market data in hand, the appraiser performs a rigorous analysis to arrive at a well-supported opinion of value. This involves carefully weighing the subject property against comparable sales, making adjustments for key differences. The appraiser's thought process should be clear, logical, and grounded in market evidence.

Appraisal Reporting

A high-quality power of sale appraisal culminates in a professional, comprehensive report that clearly communicates the appraiser's findings and rationale. The report should be well-organized, easy to follow, and compelling in its analysis. It should instill confidence in the reader and stand up to scrutiny from all parties involved in the power of sale process.

"Handling power of sales is never easy for lenders or borrowers. But in trying times, power of sale appraisals can be a steadying force. By anchoring all parties to a transparent, supportable market value, a well-built appraisal cuts through the chaos."